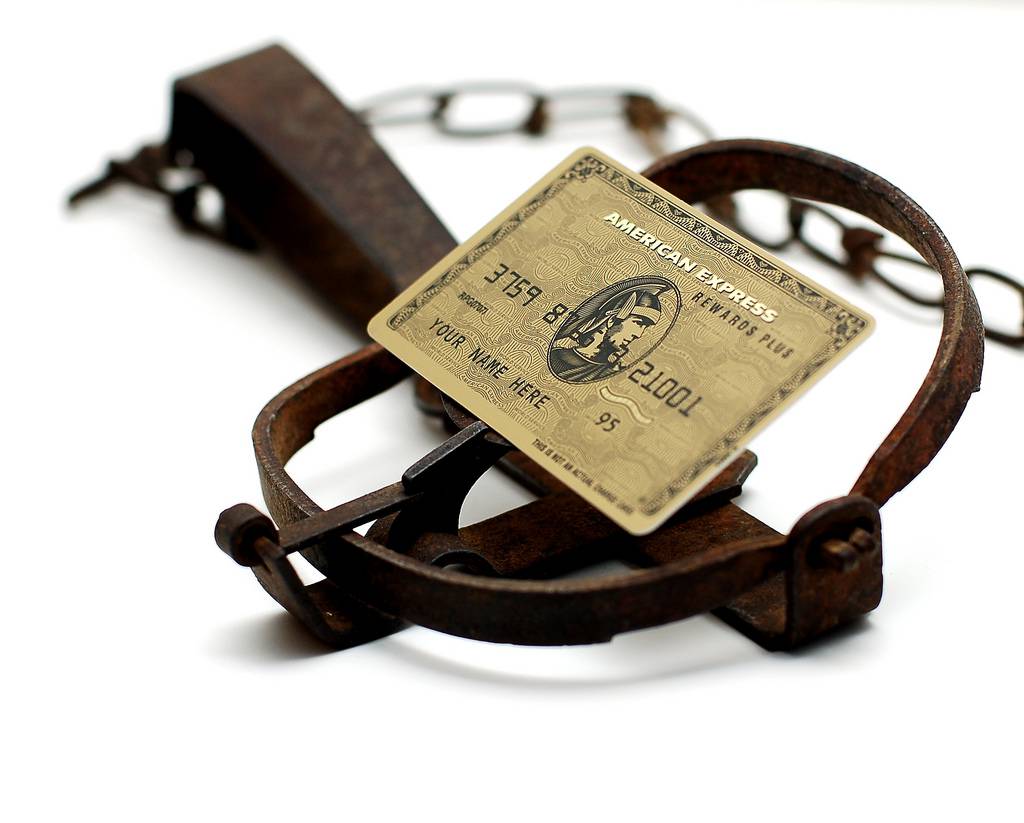

Whenever I bring up the subject of finances I start talking about Credit Cards. Almost the only point that people ever get stuck on is that I say credit cards are a stupid idea.

Somehow I manage to talk to (daily) the few percentage of people who don't spend more because they use a credit card and whose points are actually awesome.

Then I read articles like these:

-

Debt by numbers: Troubling trends in Canadian consumer spending.

-

Canadians still piling on consumer debt -- but at a slower pace

That is the truth of the world we live in. Almost everyone you know is spending more than they can afford. They are financing it with credit cards, bank loans, car loans and all other types of consumer debt.

That person with the new car next door can't actually afford to buy it, they just decided that the monthly payments were worth it. If you read The Millionaire Next Door you'll find out that the average millionaire owns their car in cash.

In fact they have owned their cars long before they were millionaire's.

Back to Credit Cards

An oft cited study about credit card spending comes from McDonald's. When they did a study they found that you spent 45% more if you used a credit card instead of cash.

I've dug around for a while trying to find that study exactly so I can cite the source. I've seen some quotes from a "McDonald's Exec" that said when they accepted credit cards at locations sales went up. No link to the original source though so it's not something I can reliable cite.

How about a study and an economics professor from Cornell University.

How you spend affects how much you spend

Robert Frank, economics Professor at Cornell University

So the study (really a 4 studies in summary in that article) found that how you spend affects how much you spend. The less like cash it is the more the average person spends.

Is it possible

Is it possible that the people I interact with (that means you) are part of the 'less than average' that don't spend more when they use a credit card?

Yes it absolutely is possible. It just feels unlikely.

It seems to me that almost any time I talk with someone about credit cards they are not part of the people that spend unwisely.

Then I talk with the same people after I've taught a financial course and they realize that they were part of that majority that was spending more with a credit card than they would with cash. They figured they were in the course for a 'bit of a tune up'.

Or maybe I talk to them a year later and find out that they have $40k in consumer debt and it grew in the last year and now they got laid off and wonder how they are going to feed their kids.

Then we use cash

Then we drop credit cards together and over the course of 3 months cut a grocery bill in half for a family of 4. Maybe we decide that there is $60/month of recurring expenses that we don't actually need once we have to use cash to pay for them.

Maybe we stop going out for dinner once a week and putting it on a credit card.

Whatever we do I have consistently noticed that those who move to cash from credit spend less than they did when using a credit card.

Then I talk with my friend down the road who rides a bike that is older and who's cycling shoes are old but who owns their 2 year old truck and owns their 2nd car and who owns their camper. They are just a guy and a girl with 2 kids. He works full time and she works part time. If you ask them they say that things really changed for them financially years ago when they dropped their credit cards and started spending cash.

Or maybe I talk to my other friend who has 6 kids and works a basic labour job and his wife waits tables part time (mainly to get out of the house). They also own 2 cars and a camper and have money saved for all of the kids college. When you ask them about credit cards they emphatically state that they are stupid and they haven't had one in, well they can't quite remember.

I admit that I've got a small sample but the people I talk to that aren't having debt issues are overwhelmingly staying as far away from credit cards as they can.

Once I really dig in with most of the people that are using credit cards, they have lots of other debt don't own their cars. Dont' have money saved for their kids college. But that's "just how the world is now".

Seems we live in two different worlds.